For example if you take up a job while overseas and you only receive the payment for the job when you are back in Malaysia. For all other investment income ie interest foreign income and taxable capital gains 3067 per cent of that income is also added to the RDTOH account.

Taxation Principles Dividend Interest Rental Royalty And Other So

Dividend income received by resident companies and limited liability partnerships.

. Estimate your take home pay after income tax in Malaysia with our easy to use and up-to-date 2022 salary calculator. Taxable Income MYR Tax Rate. Income tax calculators from other sites may show slightly different numbers due to different deductions.

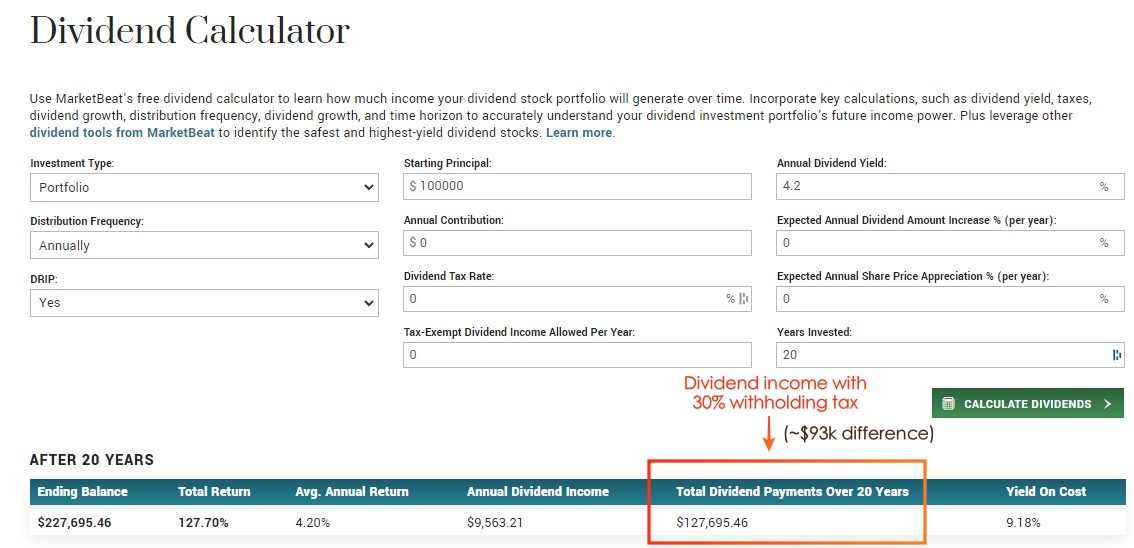

Understand the nature and source of your taxable income. Malaysia - 25 Malta - 35 Mexico - 10 Moroccco - 10 The Netherlands - 15 New Zealand - 30. As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the 25 income tax.

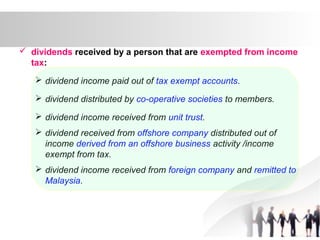

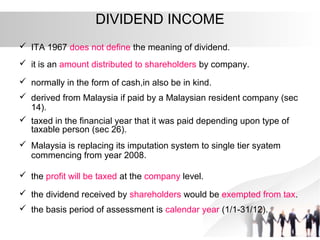

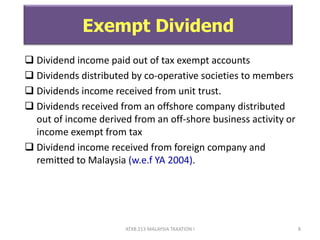

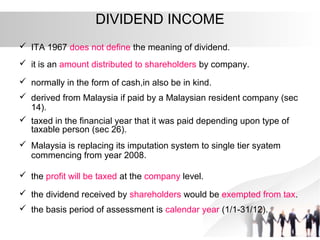

Undistributed income of foreign subsidiaries is not taxable. Dividends are exempt in the hands of shareholders. Understanding the source and nature of your income be it salary professional income like a doctor or a lawyer or income from capital gains like dividend received from shares in a company is the first step in your financial journey.

In principle dividends are taxed at graduated rates after being aggregated with other sources of income however dividend paid by corporations listed on an exchange are opt to be taxed separately from other sources of income at a flat rate of 20315 ie. The nature of taxation of that income is then secondary. This allows the REIT to distribute its income on a gross basis.

15315 national tax and 5 local inhabitants tax. When the corporation pays a taxable dividend to shareholders itll receive a tax refund of 1 for every 261 of dividends paid up to the balance of the RDTOH account. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

KUALA LUMPUR Aug 19. With this tax system most Malaysian REITs if not all distributes at least 90 of its taxable income. 2 days agoFurther as an Australian company PIA pays tax on its taxable income thereby generating franking credits which can then be passed on to investors when PIA pays its quarterly dividends.

From 20000 to 35000. From 5000 to 20000. Malaysia is under the single-tier tax system.

For tax credits investors must fill out Form 1116. Sentral Real Estate Investment Trusts REIT net property income for the second quarter ended June 30 2022 2QFY22 slipped 38 to RM2794 million from RM2904 million a year earlier on lower revenueEarnings per unit decreased to 172 sen from 211 sen the REIT said in a filing with Bursa MalaysiaQuarterly revenue was down. Corporate - Branch income.

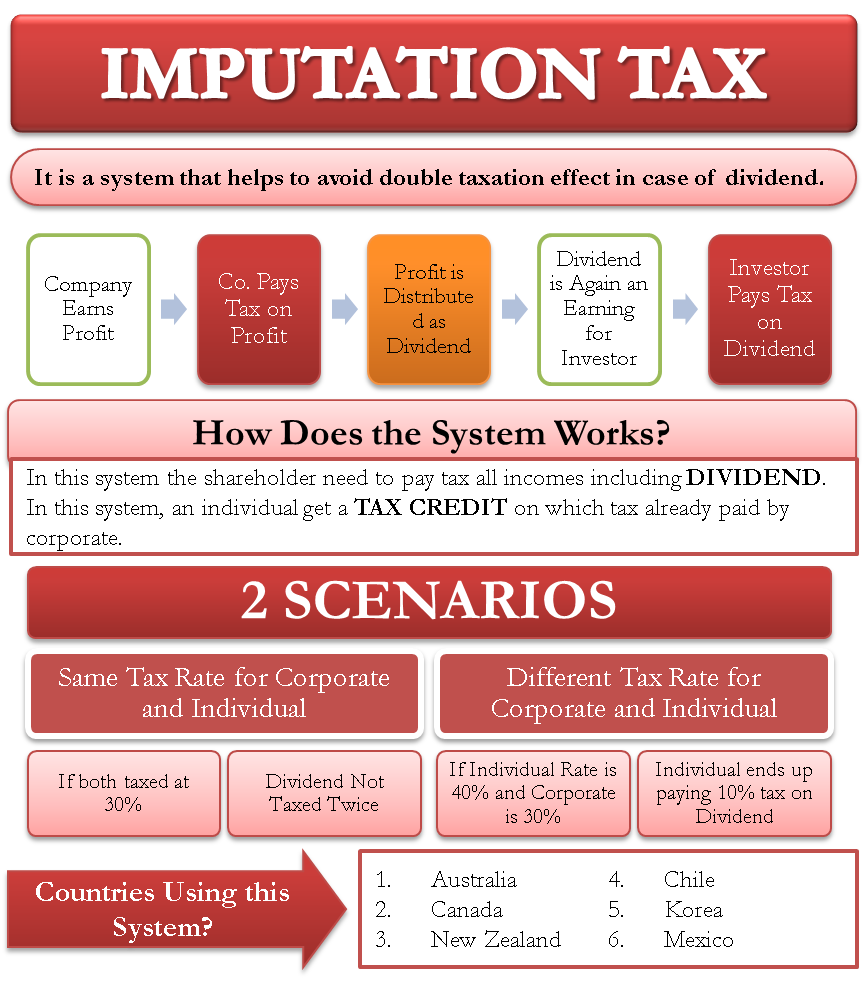

This is in place to help avoid double taxation of dividend income. Itemized reductions will reduce taxable income while an income tax credit can actually be used to pay off tax liabilities. PIAs global share portfolio is well diversified typically investing in about 70 quality growth companies with overweight positions in the healthcare.

Dividend Yield Formula And Calculator Excel Template

A Complete Guide For Investors On Tax On Dividend Income Ebizfiling

Taxation Of Dividend Income And Capital Gains

Imputation Tax Meaning How It Works And More

Dividends Passive Income No Money Lah

What S Your State S Dividend Income Tax Thinkadvisor

What Is The Taxability Of Dividend Income

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

How Much Money Do You Need To Have Invested To Live Off Dividends By Marcus Tan Geek Culture Medium

Chapter 5 Non Business Income Students

Taxation Principles Dividend Interest Rental Royalty And Other So

Dividends Passive Income No Money Lah

Sponsored All You Need To Know About Dividend Withholding Tax For Malaysians Stocks Etfs No Money Lah

What Salary Makes You Eligible For Paying Income Tax In Malaysia Income Tax Salary Income

All About Dividend Income From Foreign Company In India Ebizfiling

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Candlestick Chart Patterns Trading Charts Stock Trading Strategies Trading Quotes

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)